How many members are there?

Our 400 members include about 330 management companies, which collectively account for 90% of the € 5.0 trillion in assets under management in France.

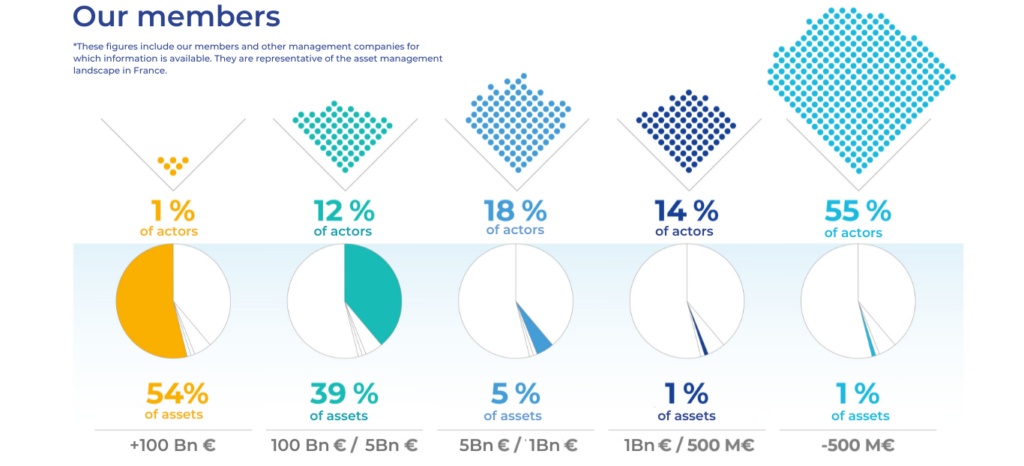

From small businesses to global leaders

Breakdown of members by assets under management

Our members are subsidiaries of banking and insurance groups, with four of these firms ranking among the top 25 globally. Additionally, there are numerous “petites boutiques,” or boutique firms, founded by entrepreneurs—this unique characteristic is highly regarded by investors worldwide.

There are generalists and specialists including experts in active and passive management, quantitative and alternative strategies, discretionary portfolio management, private wealth management, private equity firms, real estate asset managers, and pioneers in socially responsible investment.

Along with a whole ecosystem of financial specialists and service providers

A hundred or so “correspondent” members, including lawyers, consulting and auditing firms, statutory auditors, financial information providers, etc., strengthen the French asset management ecosystem.