Companies need funding to drive their growth, digital transformation, and zero-carbon initiatives. They rely on asset managers to provide the financial resources required to achieve these objectives.

Creating jobs

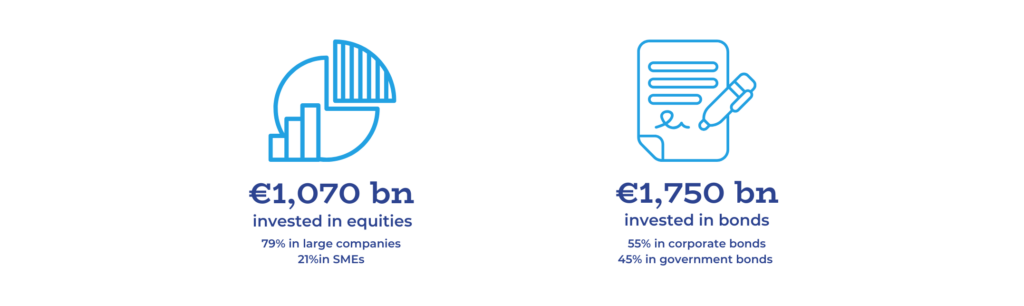

Asset managers finance companies in several ways:

By buying shares, they enhance the company’s value and become its shareholders.

By acquiring a portion of its debt, they provide essential funding and become creditors.

Asset managers finance all businesses:

From local SMEs and emerging tech startups to publicly listed companies and CAC 40 groups, their financing meets a broad spectrum of needs. It offers solutions for short-term cash flow, as well as medium- and long-term funding through both equity and debt.

Asset management is a cornerstone of the economy.

By investing savings in companies and innovative projects, asset management enhances competitiveness, fosters the development of new skills, and promotes full employment.

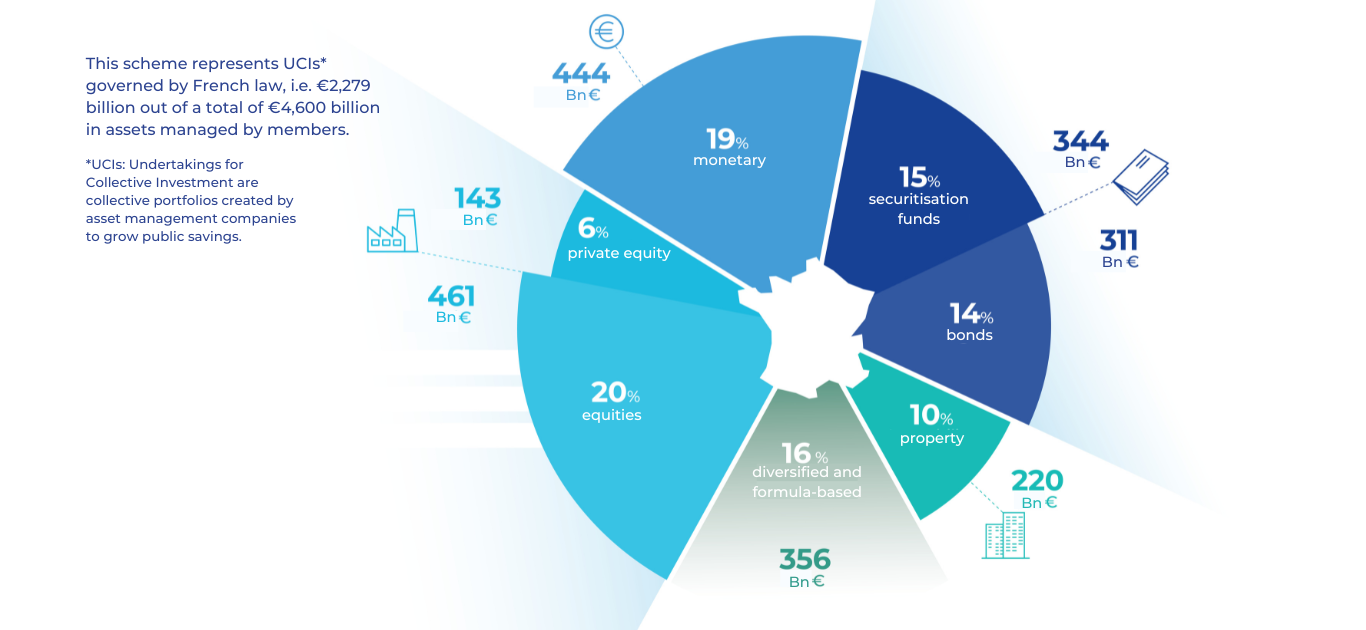

Breakdown of assets under management by type

For successful transitions

Asset managers play a crucial role in accelerating the ecological transition

They supply companies with the necessary resources to decarbonise their operations and encourage improved practices by engaging in constructive dialogue and supporting climate resolutions at shareholder meetings.

French asset managers have been at the forefront of sustainable finance for 25 years, establishing themselves as global pioneers in this area. The European CSRD* Directive, set to take effect in the 2024 financial year, will advance corporate sustainability reporting significantly.

Technological innovation is set to emerge from France.

Artificial intelligence, big data, digital twins, sovereign cloud solutions, and cybersecurity are all vital technological drivers for the French economy. By financing innovative technology projects, asset management plays a crucial role in shaping the future of this sector and facilitating the digital transformation of French companies.

*CSRD: Corporate Sustainability Reporting Directive

To support major projects

Financing States and infrastructure projects is a key role of asset management.

The relocation of strategic industries, the transition to renewable energy, the development of 5G networks, the construction of highways and airports, social housing initiatives, and pension financing are all critical projects that demand significant long-term investment.

Around the world, asset managers are playing an increasing role in financing these infrastructures and systems, which benefit the greatest number of people. They enable savers in turn to invest their savings in major projects.