Financial education

An informed saver is worth a thousand

They think strategically about their financial goals—whether it’s financing a property, planning for retirement, or saving for an exceptional trip. They tailor their investment horizon to align with their objectives and risk tolerance. By diversifying their portfolio and actively monitoring its performance, they enhance their potential for achieving long-term success.

Making saving accessible to all is a key social challenge.

The AFG is actively involved in the national financial education strategy spearheaded by the Banque de France, which aims to enhance financial literacy from an early age. Its educational guide, “12 Principles for Saving and Investing“offers both savers and professionals a clear framework, organized around four essential questions to consider, four key concepts to grasp, and four practical tips for making informed financial decisions. Additionally, the guide “Sustainable Finance. 9 questions to understand ” introduces individuals to the principles of responsible investment.

Through its social media campaigns, the AFG strives to reach a broad audience, emphasizing the importance and benefits of saving for the future.

Meaningful savings are more impactful savings

Informed investors recognize the impact of their savings on the economy. They prioritize the growth of businesses, local communities, and the wider European economy. They embrace sustainable finance and contribute to an economy that reflects their social and environmental values.

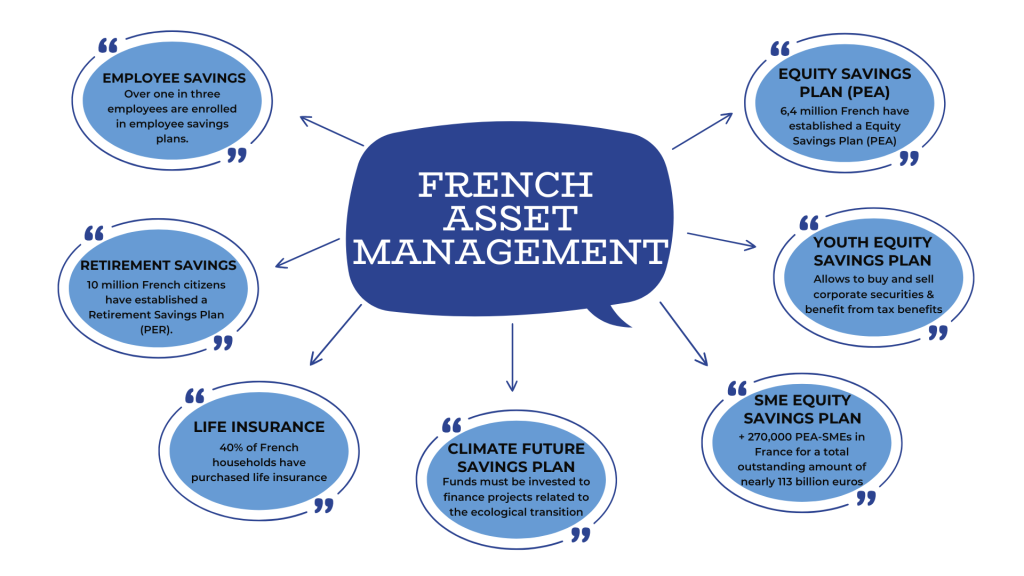

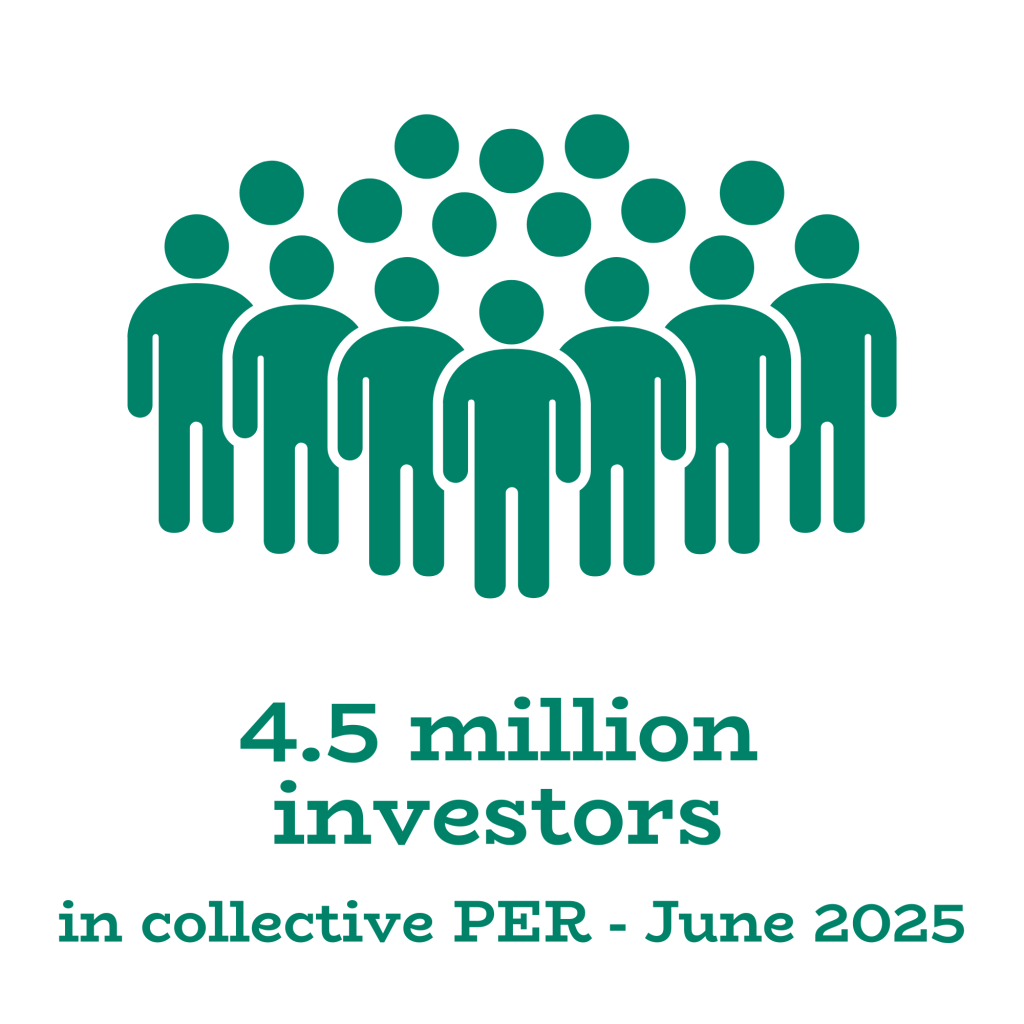

Providing Accessible Savings Solutions for All

The primary mission of asset managers is to grow the capital entrusted to them by investors. They construct diverse portfolios in which your savings are strategically invested. Whether it’s through a life insurance policy or a PEA (Plan d’Épargne en Actions), an asset manager is diligently working behind the scenes to manage and optimize your savings.