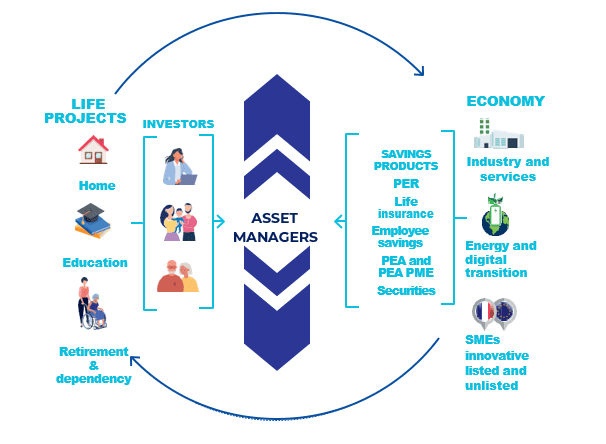

Asset management creates a bridge between savers and the economy

Origin :

savings

Savers are looking to finance their life projects (real estate, retirement, health, education).

The pivot :

asset managers

– They match savings and investment

– They add value to savers’ assets throughout their lives

– They support the growth of companies and the major projects of governments

Destination :

Economy

– SMEs and large companies, innovative start-ups

– Local authorities

– Technological and energy transitions

– Public policies (education, retirement, dependency, etc.)

True and false ideas about asset management :

An asset management company is not a bank.

TRUE

An asset management company is not a bank. Its role is to manage and invest savings funds, but not to hold them. Unlike banks, it neither collects nor holds savers’ deposits.

Investors have no control over the risk of their investments.

FALSE

Investors retain control over the level of risk they wish to take. By defining their investor profile (cautious, balanced, dynamic…), they can choose investments suited to their risk tolerance and return objectives.

Insurance companies entrust us with their investments.

TRUE

Some of the funds managed by asset management companies come from investments entrusted to them by insurance companies, notably through life insurance policies. They draw on the expertise of asset managers and benefit from a solid regulatory framework.

70% of funds managed in France are invested in Europe, particularly in France.

TRUE

Around 70% of funds managed in France are invested in Europe, particularly in France. These investments finance companies, infrastructure (such as solar farms or high-speed rail lines), real estate and public debt, contributing to structural projects such as the financing of pensions.

French asset management is not regulated.

FALSE

Asset management in France is subject to strict regulation. It operates under the supervision of European regulations, French law and the Autorité des marchés financiers (AMF). These rules aim to protect investors and ensure the stability and transparency of financial markets.

French asset management is No. 1 in the EU

TRUE

With around €4,700 billion in assets under management, France is the leading player in the European asset management market, accounting for 31% of the European Union total. This leadership is based on recognized excellence and strong international competitiveness.